Financial Calculator Compound Interest Daily

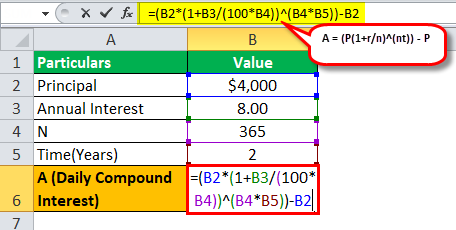

Multiply your principal amount by one plus the daily interest rate as a decimal raised to the power of the number of days youre investing for. You can use it to calculate.

3 Ways To Calculate Daily Interest Wikihow

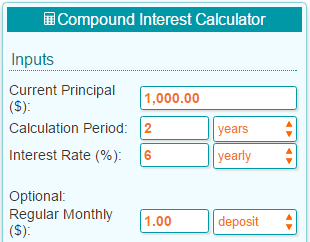

This compound interest calculator has more features than most.

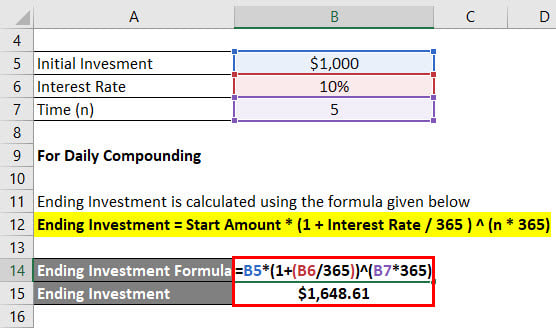

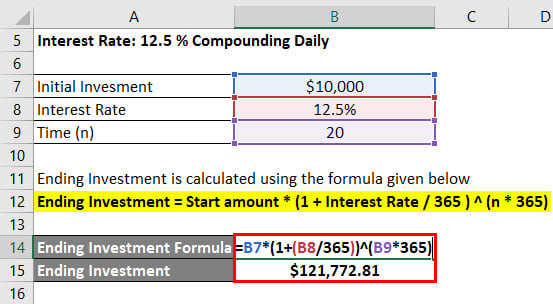

Financial calculator compound interest daily. Daily compound interest is calculated using a simplified version of the compound interest formula. You can vary both the deposit intervals and the compounding intervals from daily to annually and everything in between Show Full Instructions. Determine how much your money can grow using the power of compound interest.

Then the balance after 6 years is found by using the formula above with P 1500 r 0043 43 n 4 and t 6. We start with A which is your investment horizon or goal. User enters dates or number of days.

After placing each of the example numbers into the financial calculator the answer would be 674425. User chooses compounding frequency. In other words the results of.

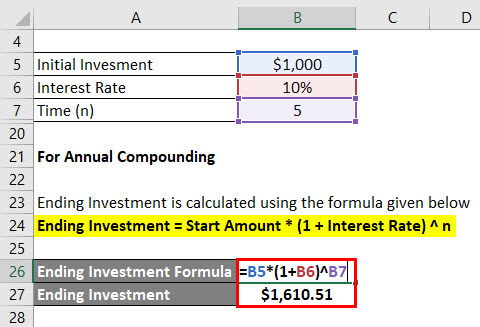

Subtract the initial balance if you want just the compounded interest figure. To calculate your future value multiply your initial balance by one plus the annual interest rate raised to the power of the number of compound periods. Compound Interest Formula FV PV 1 i N PV present value FV future value maturity value.

Because this calculator is date sensitive and because it supports many compounding periods it is a suitable tool for calculating the compound interest owed on a debt. You can either calculate daily interest for a single loan period or create a loan schedule made up of multiple periods each with their own time-frames principal adjustments and interest rates. Calculate the compound interest.

You can also enter negative interest rates. Calculate compound interest on an investment 401K or savings account with annual quarterly daily or continuous compounding. How to calculate daily compound interest.

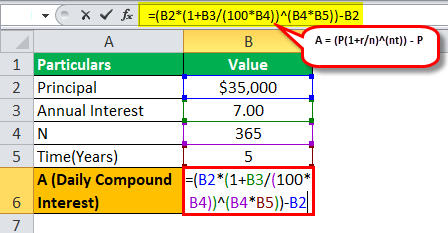

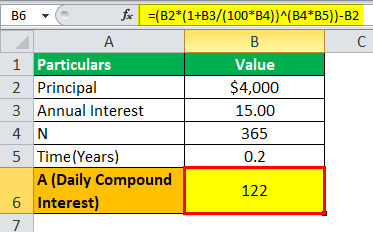

In most loans compounding occurs monthly. A P 1 rnnt Although it is easier to use online compound interest calculators all investors should be familiar with the formula because it can help you visualize investing goals and motivate you in terms of planning as well as execution. To calculate the future value of your investment with semi-annual compounding enter 2 as the Compounding periods per year value.

The compound interest calculator lets you see how your money can grow using interest compounding. Suitable for savings or loan interest calculations. We provide answers to your compound interest calculations and show you the steps to find the answer.

For weekly interest rates enter 52 this is how many weeks each year contains. Suppose a principal amount of 1500 is deposited in a bank paying an annual interest rate of 43 compounded quarterly. This compound interest calculator calculates interest between any two dates.

Calculates interest amount and ending value. Compound interest means the interest from preceeding periods is added to the balance and is included in the next interest calculation. The total initial amount of your loan is then subtracted from the resulting value.

Compound Interest Calculator Weekly daily monthly or yearly compounding with monthly contributions to calculate how much your money can grow using compound interest. Adjust the numbers accordingly for your investment vehicles to calculate the compound interest you can expect to receive. A dozen compounding periods are supported did we miss any.

Compound interest is interest that is earned not only on the initial principal but also on accumulated interest from previous periods. Compound interest calculator with monthly contributions gives you the option to include monthly yearly contributions. This Daily Interest Loan Calculator will help you to quickly calculate either simple or compounding interest for a specified period of time.

Compound interest is calculated using the compound interest formula. You can calculate compound interest with a simple formula. For more information about or to do calculations involving APR please visit the APR Calculator.

So the new principal after 6 years is approximately 193884. The basic formula used to calculate compound interest is as follows. It is calculated by multiplying the first principal amount by one and adding the annual interest rate raised to the number of compound periods subtract one.

If you are interested in daily compounding enter 365 and so on. Subtract the principal figure from your total if you want just the interest figure. This flexibility allows you to calculate and compare the expected interest earnings on various investment.

Generally the more frequently compounding occurs the higher the total amount due on the loan.

Compounding Interest Calculator Yearly Monthly Daily

Daily Compound Interest Formula Step By Step Examples Calculation

Daily Compound Interest Formula Step By Step Examples Calculation

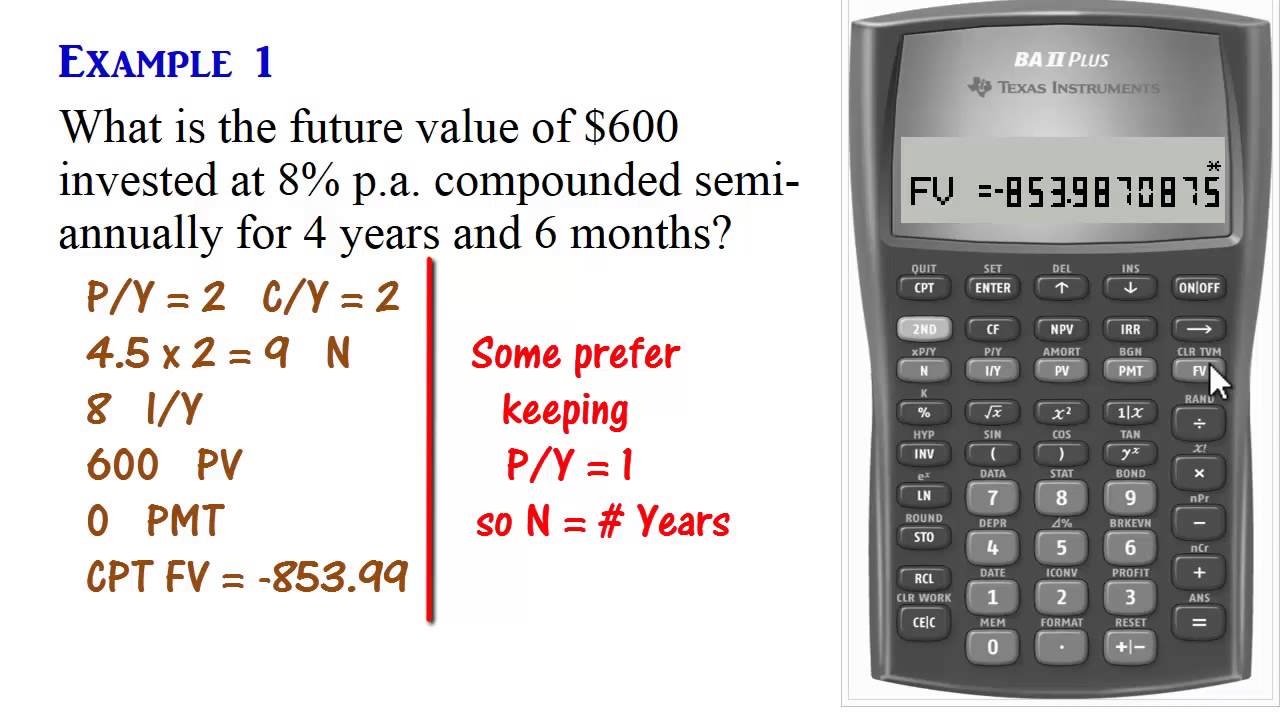

Ba Ii Plus Calculator Compound Interest Present Future Values Youtube

How Can I Calculate Compounding Interest On A Loan In Excel

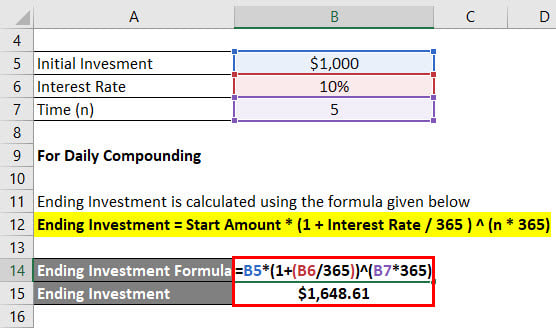

How Do I Calculate Compound Interest Using Excel

Excel Formula Calculate Compound Interest Exceljet

Daily Compound Interest Formula Step By Step Examples Calculation

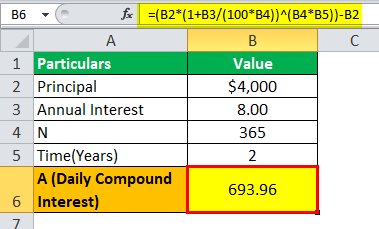

Daily Compound Interest Formula Calculator Excel Template

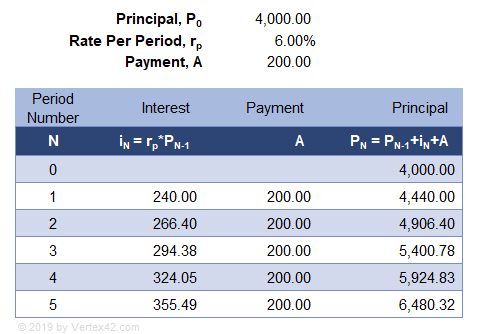

Compound Interest Calculator For Excel

Daily Compound Interest Formula Calculator Excel Template

Daily Compound Interest Formula Calculator Excel Template

Compound Interest Calculator For Excel

Compound Interest Formula With Calculator

Daily Compound Interest Formula Step By Step Examples Calculation

Indices Are The Best Way To Calculate Compound Interest

Daily Compound Interest Formula Calculator Excel Template

Daily Compound Interest Formula Calculator Excel Template

Daily Interest Calculator Simple Or Compounding Between Dates

Post a Comment for "Financial Calculator Compound Interest Daily"